The year 2025 ended with the humbling of the Nigerian state by a foreign power. That humiliation began in November

read more ‘Guns-a-blazing’: Trump’s unilateral strike betrays Nigeria’s hollow sovereignty

The year 2025 ended with the humbling of the Nigerian state by a foreign power. That humiliation began in November

read more ‘Guns-a-blazing’: Trump’s unilateral strike betrays Nigeria’s hollow sovereignty

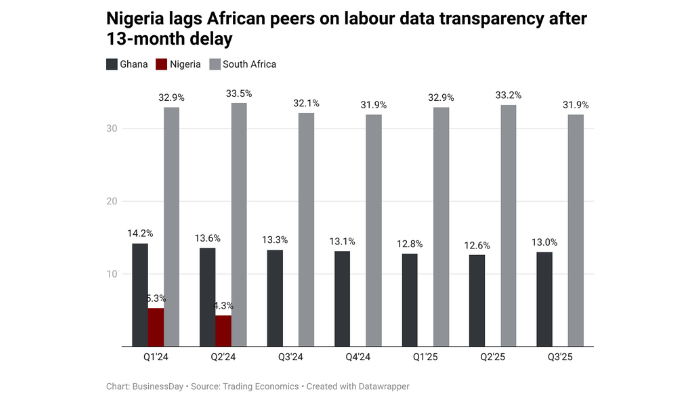

…Released Q2 2024 figures in November 2024 It has been 14 months since the National Bureau of Statistics (NBS) last

read more Africa’s giant delays unemployment data 14 months on

As Nigeria basked in the euphoria of the festive season, millions of homes and businesses were plunged not into light

read more Why festive demands keep knocking national grid offline

Every modern economy survives on a fragile but essential bargain between the state and its citizens. Governments demand taxes, citizens

read more Nigeria’s 2025 Tax Reform: Revenue without trust is not reform

Nigeria’s benchmark interest rate is likely to remain above 22 percent through 2026 as the Central Bank of Nigeria (CBN)

read more Markets bet on prolonged tight policy as CBN defends inflation, naira

…ASI up 51.19% year-to-date Nigeria’s equities market delivered an exceptional performance in 2025, rewarding investors with a 51.19 percent return,

read more Stocks extend rally, close 2025 with N36.62trn gain

The Economic Community of West African States (ECOWAS) may face significant headwinds in fulfilling its pledge to slash airfares in

read more Market realities may derail ECOWAS’ affordable travel plans in 2026

Nigeria’s benchmark interest rate is likely to remain above 22 percent through 2026 as the central bank prioritises inflation control

A Cultural Accident That Became an Economic Asset Detty December was never a government blueprint or a carefully sequenced tourism

read more The Detty December Bubble: How Nigeria is pricing itself out of a billion-dollar cultural economy

“Tomorrow belongs to the people who prepare for it today.” — African Proverb A new year is a clean ledger

read more Five decisions boards and business leaders must make now — The 2026 playbook