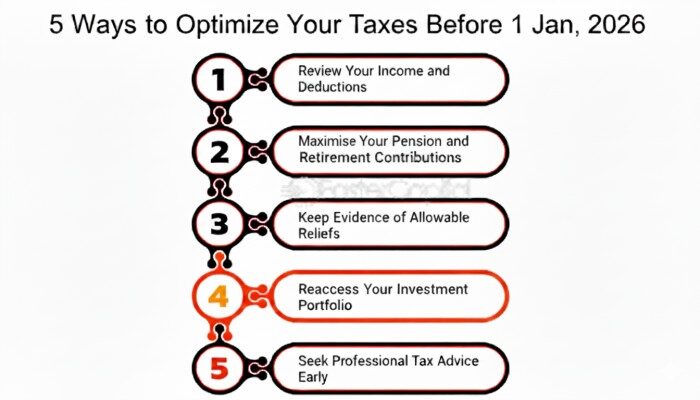

As Nigeria prepares to roll out the new Nigerian Tax Act (NTA) in 2026, individuals have a short window to

read more 5 smart tax moves every Nigerian should make before 2026

As Nigeria prepares to roll out the new Nigerian Tax Act (NTA) in 2026, individuals have a short window to

read more 5 smart tax moves every Nigerian should make before 2026

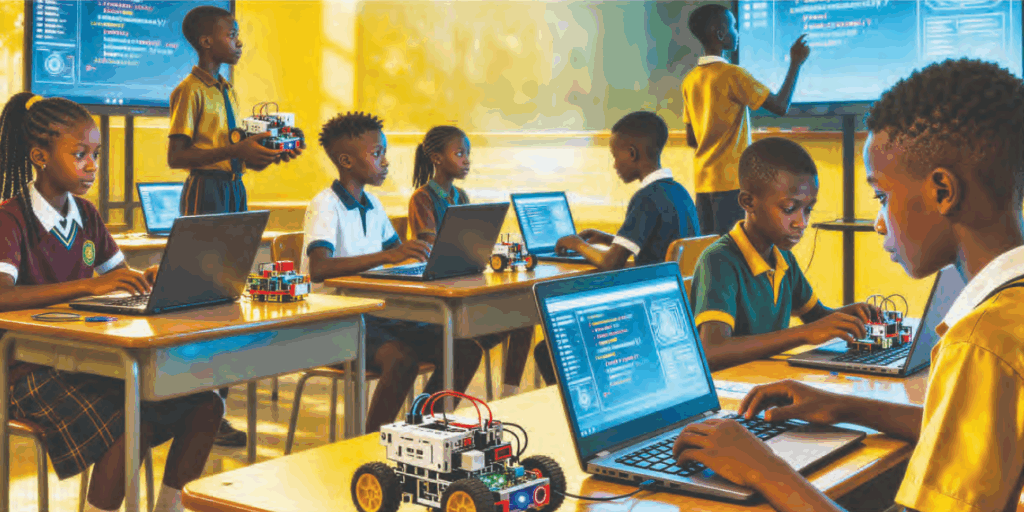

The true wealth of every developed nation, across eras and continents, lies not in mineral resources, military power, or foreign

read more A nationally-driven technical education must anchor Nigeria’s next development phase

The Nigeria Tax Act (NTA) repeals and replaces several major tax laws, including the Companies Income Tax Act (CITA), Personal

read more 5 scenarios where foreign income becomes taxable in Nigeria

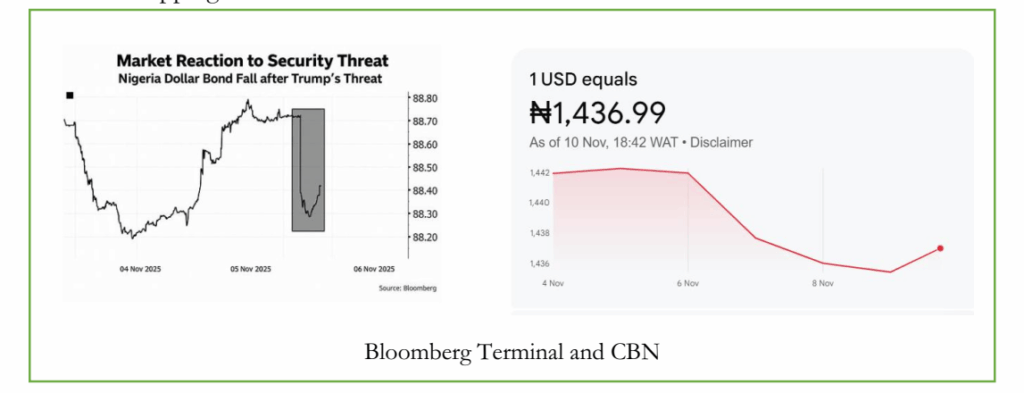

From proxy rivalries to sweeping political shockwaves, Africa’s largest economy in early November 2025 was once again in the eye

read more Confidence over Chaos, and the Trump-Nigeria Tension

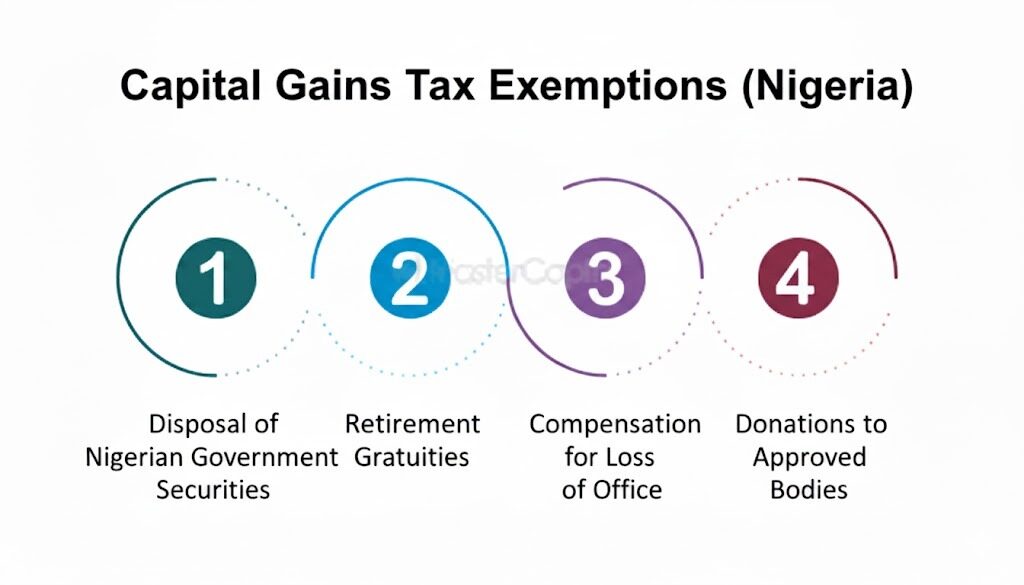

As part of its broader fiscal reform agenda, the Federal Government has introduced several tax and policy changes aimed at

read more 14 bold tax reforms set to energise Capital Market

Nigeria is embarking on a comprehensive overhaul of its fiscal structure, driven by the critical need to increase the nation’s

read more How new Personal Income Tax shift will reshape what you earn and pay

A fourfold capital hike promises sector transformation. The evidence suggests something messier. When Nigeria’s insurance regulator announced fourfold increases in

read more Nigeria’s insurance recapitalisation: Shock therapy or expensive theatre?

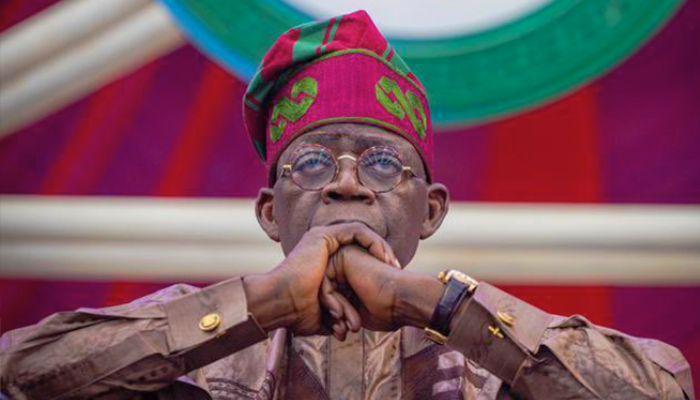

However much the Presidency tried to explain away President Bola Tinubu’s last-minute cancellation of this year’s Independence Day parade, it

read more Coup scare: Nigeria needs citizen activism, not military intervention

In the 1960s, Nigeria’s healthcare system stood as a regional benchmark. Lagos University Teaching Hospital (LUTH) was the destination for

read more Nigeria’s healthcare crisis needs more than government spending, it needs ingenuity

Private Equity (PE) firms that invest in certain sectors covered under the Startup Act are fully exempted permanently and forever,

read more Private Equity firms get CGT relief on Startups as other exits remain taxable