Nigeria’s ongoing tax reforms are not about introducing new levies or imposing additional burdens on citizens, despite widespread misconceptions. Rather,

Nigeria’s ongoing tax reforms are not about introducing new levies or imposing additional burdens on citizens, despite widespread misconceptions. Rather,

There’s a certain allure to seeing a substantial sum sitting comfortably in your bank account. It can inspire a sense

read more Cash in motion: Why idle funds are a business risk

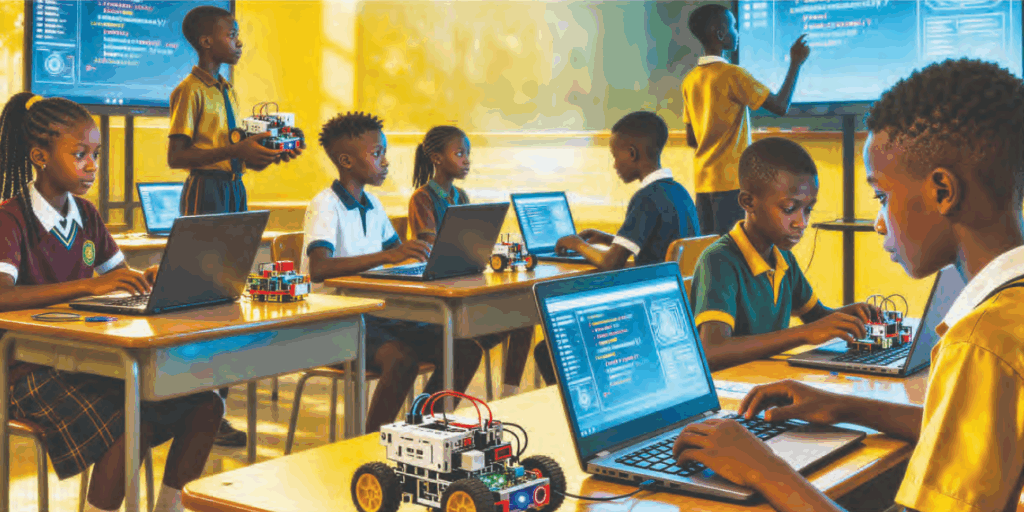

The 21st century has been defined by an unprecedented acceleration in technology – a revolution that has transformed economies, redefined

read more From consumers to creators: redefining Nigeria’s place in the global tech economy

Every human being wants to be appreciated for what he has done. It’s a fundamental need that cuts across all

Some years ago, a woman told me how her friends took her shopping for Asoebi. They said it was “the

read more Wealth Illusion: Why so many high-earning women stay broke

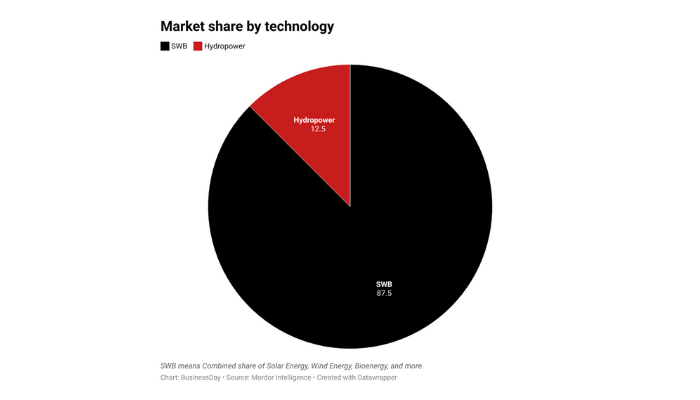

For years, Nigeria’s power story was one of scarcity and strain. Generators filled the silence left by the national grid,

read more How renewables became Nigeria’s most bankable asset

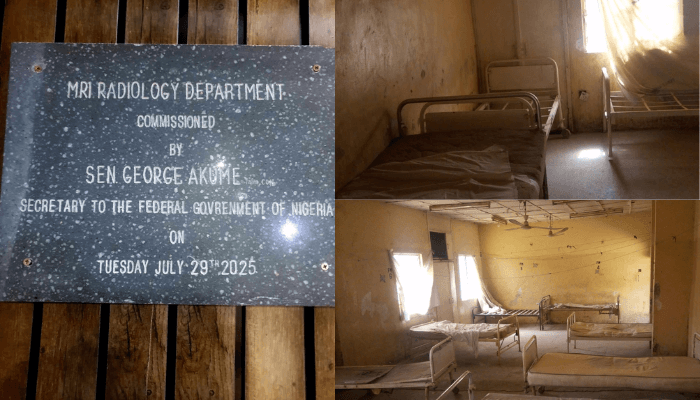

…Victims share heartbreaking stories About a year ago, what should have been a story of survival turned into a tragedy

read more A syringe for a life: How poor health facilities cost lives

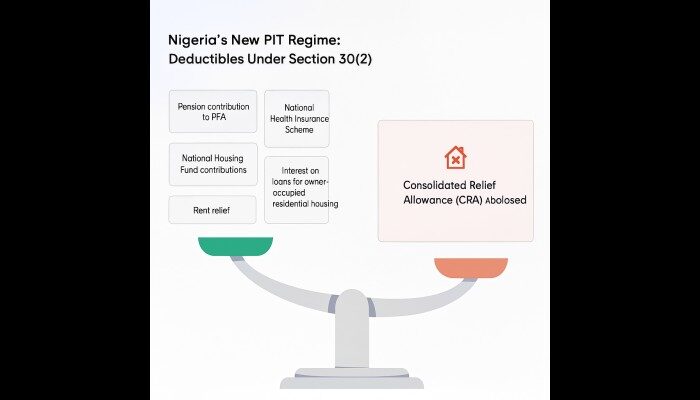

Nigeria’s personal income tax system has recently undergone significant reform. Previously, income earners benefited from a simple tax structure that

read more 6 tax deductions you can claim under new PIT rules

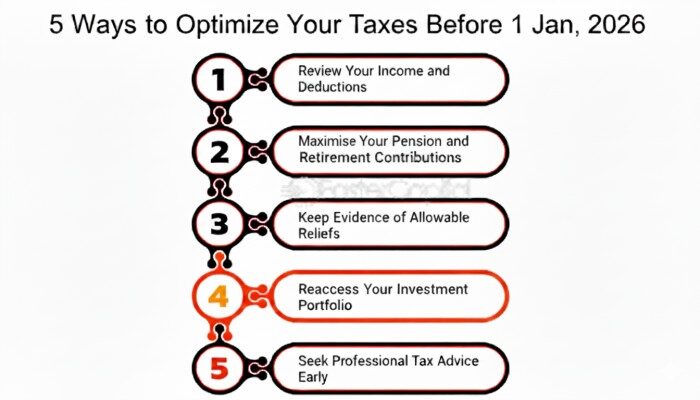

As Nigeria prepares to roll out the new Nigerian Tax Act (NTA) in 2026, individuals have a short window to

read more 5 smart tax moves every Nigerian should make before 2026

The true wealth of every developed nation, across eras and continents, lies not in mineral resources, military power, or foreign

read more A nationally-driven technical education must anchor Nigeria’s next development phase